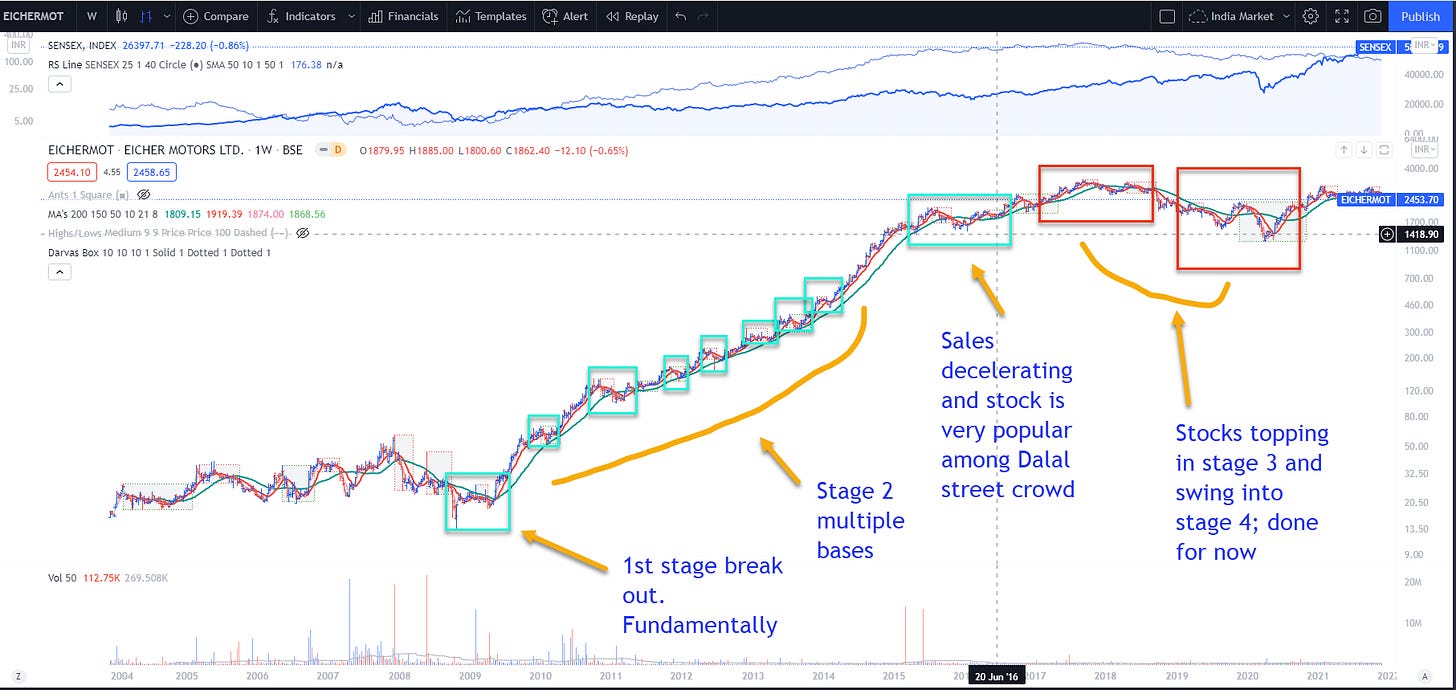

Multi-Bagger Series: EICHERMOT - Royal Enfield Bullet Lal returned 114 fold return (114,43%) in 8 years to astute growth stock traders

Model Stock: EICHERMOT

This is a continuation of Multi-Bagger series. With this article, I will showcase different super winners or monster stocks or multi-bagger. All these terms means the same, stocks returning several hundreds of percentage.

Model Stock: EICHERMOT

The 1st model stock I will be focusing on EICHERMOT stock.

This stock returned 114,43% in 8 years. Your money got multiplied by 114 times. An investment of Rs.500,000 in 2009 has turned into Rs5.8 crores. Yes, you read this correctly. No typos. Stop dreaming and please continue reading :)

This is my most favorite stock of my market life cycle experience. This stock I can’t ignore to call out and show its phenomenal return to its shareholder & growth stock traders.

Bullet Man

He is the CEO of Eicher Motors. The bullet man who really saved the Royal Enfield from dying in early 2000.

Anyone remember this bike? This used to be its trademark image until its company turnaround - a huge bulky, noisy, smoky one. While Yamaha or Suzuki models were sleek and fancy during those time. However, people riding feel powerful due to its ruggedness.

This bike was VERY heavy, had many issues, not fuel efficient either. company struggling from an image-crisis, languished in sales and was on the brink of closing these manufacturing facilities.

Mr.Lal turned around the company in 2004 by reengineering the design, look and created a huge brand impact. He had A++ engineers in his team. Rest is history. Today, it is one of the coolest bike youngsters wants to own and ride. Now, it has pricing power like Apple products.

Lets get to the basics of growth stock investing on this model stock. BTW, the market structure for growth stock characteristics is same whether it is US or India or Hong Kong or Sweden or Singapore or Dubai stock market.

EICHERMOT - Fundamental Characteristics

For historical Sales and Earnings data, I typically go to company website and perform the analysis, read their investors presentation. < Link:>

I was on a summer vacation in India during 2006, 2007, 2008 and each year I started noticing many were driving these bikes. It got fancier and stylish with each year progression. Then I started digging into the details of the company, I was stunned on how fast the sales were growing.

But, around the same time in 2008, there was lot of uncertainty in the market, financial crisis, housing bubble. The market was in down trend and I was getting educated heavily on CANSLIM methodology.

This stock belongs to F3 Category in my series - Turn around story stock

EICHERMOT - Technical analysis

EICHERMOT - 1st stage breakout

EICHERMOT - Run up

EICHERMOT - Topping

** This stock had a split of 10 shares for each share. The price above are split adjusted.

EICHERMOT - Portfolio, Risk and Trade Management

This stock has been traded as a concentrated position management with a long-term goal. To keep it simple I removed/avoided the trading commissions, dividend, covered call sale, and margin account..etc., Emphasis on the trade management - buying and selling, risk management and most important position/portfolio management.

These are my real trading journal templates which I gained from years of learning from others and self-taught:

This return is unimaginable for an average person even with real estate investment during the same period. Note, this instrument is highly liquid and transparent transactions. Think for a second!

If you need this template, please email me, that shows you have read this article and have a firepower to learn and explore. Congrats and Best Returns to who are reaching out to me!!

EICHERMOT - Summary

My inspiration started for this stock with my 1st trading book - One up on Wall Street by Peter Lynch . Very powerful book. We all come across in our life these stocks. By simple observation what products our spouse, children, family & friends use and why they are after certain products we can find a gem stock - Apple, Ugg Boots, Crox, Ulta Salon, Sketchers, Fossil, Facebook, Snapchat, Tesla, Fortinet, Amazon etc., Research the company, trade by rules I have explained you can make a difference to your financial life.

This rock star trading is based on the market direction, sector strength , fundamentals of the company, its projected sales/earnings fire power, concentrated position trading , sell on strength or weakness. In this case, sold offensively as it sales/earnings started decelerating. (sold per rules, very fortunate and no regrets). Not marrying but dating the stock - enter, ride and exit. Cut the loss when you are wrong.(mostly we will be wrong due to the stock or market timing but not afraid to buy back when all stars align). Simple as it is. Our goal is to extract and exploit on these fundamentally powerful momentum stocks. Be humble always when it comes to trading.

More model stocks on the away. Stay tuned :-) Hey, if you like this article and want others to learn and succeed why not share it?

Full Disclosure - I don’t own this equity at this time of writing - DEC 2021.