What is an IPO base?

Trading IPO stocks

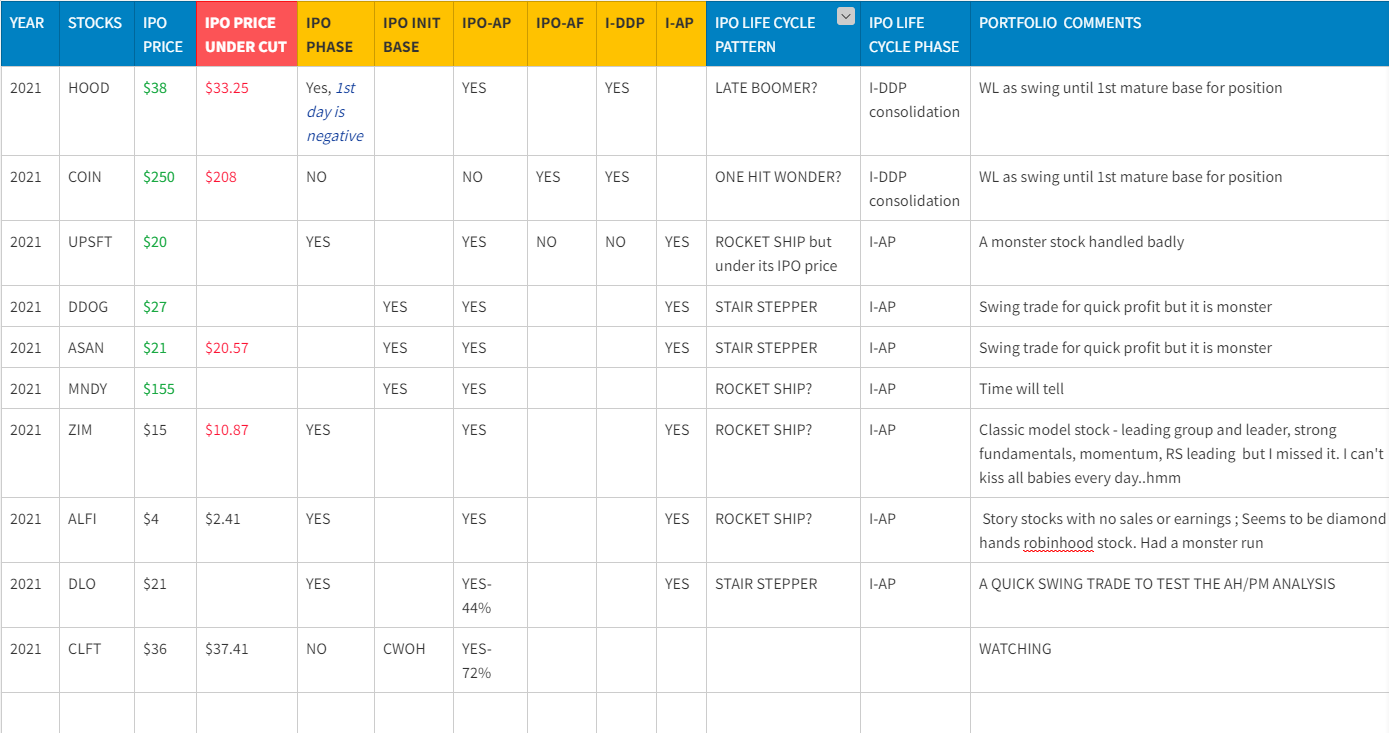

IPO-SUPER GROWTH -MONSTER STOCKS

Below are some of the classic IPO stocks had a monster run before break down. Home Depot had 2500% return on from its IPO base. Never ever ignore it. 2 out of 100 IPO stocks will be a super performance IPO so study them.

IPO BASE: A classic IPO base is short and shallow area of consolidation structure ; 20% to 50%(mkt); happens within 25 days ( 2 to 5 weeks, Under Writer expiration) of IPO. Sometime it can be short as 7 days. Classic pattern - GOOG, MA, CMG, V, KORS. This is the beginning of IPO base structure, technically it shouldn't violate.

IPO DAY - Offer price -> Closing HIGH - Closing LOW begins the IPO structure

IPO INITIAL BASE: This base is formed after 25 days but within the IPO base HIGH. AMZON

1ST MATURE BASE: IPO base structure violated or takes longer time. Liquidity begins. Technical action of volume accumulation, 9M BO's(ZM), improving sales and earnings, the base was under pressure due to market conditions, shows mutual funds accumulation, TO - company is a transformation (ZM, LVGO, TASR)

TURBULENT ZONE - 2ND MATURE BASE: Towards the end of the consolidation forms the turbulent zone of resistance or base within a base (TSLA)

PORTFOLIO MANAGEMENT for IPO & INITIAL BASE: if stock close not fail immediately and is up at least 5% to 10% after break out then hold until 8th week close. Now sell partial or full. After 8th week close, hold until decisive break down of 10-week MA line.

Let us look COVID-19 rock star stock - Zoom. Pre-covid19 IPO buy is about 1300 % return and COVID lock down buy would be 500 % .