Multi-bagger series - Introduction: Part 3 - Market Direction, Sector Strength and Stocks Relative Strength

Dashboard - Market Direction, Sector and Stock RS are critical

This is continuation of Multi-Bagger series. This is last part of core concepts before model stocks showcase. I want to wrap and close the concepts with this article. Bear with me.

Apart from the fundamentals and technical strength of growth stocks selection and management, there are 3 key factors that influences it performance and risk management. I. Market Direction 2. Stocks Sector Strength and 3. Relative Strength of the stock:

Part 3MARKET DIRECTION

In the stock market operations, everything can go right but if you are wrong about the general market direction, and the direction is down, your stock will plummet heavily. Growth stocks corrects 2-4 times the factor of market correction. Your portfolio can draw down to 50% easily.

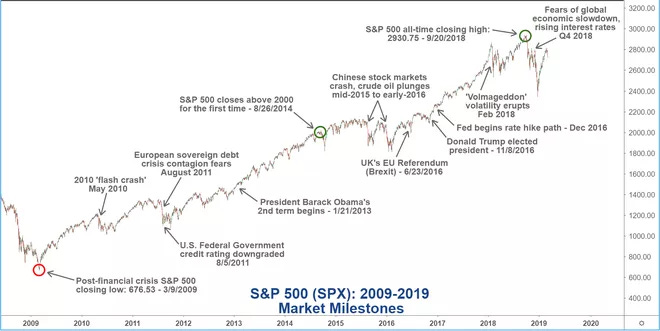

The market cycle runs in bull and bear market cycle phases. The bull cycle is a long duration and it can run several years with minor corrections. The bear market is typically short duration of a year or two with multiple short rallies. This cycle has repeated in the past and will repeat in future too. Based on the historical data, we typically assume an upward market bias. This will be the case as long as US remains as hub of innovation and capitalism is prevailed.

For over a century, a typical, multi-year bull market in the U.S. consisted of three stages. The first stage(accumulation) is the recovery from crazy bear market lows. (2003, 2009, COVID-19 March 2020). The second stage(big move) is a steady improvement, in gear with a general improvement in the economy - longest one. The third stage(excess) is the speculative one, when newcomers pour into the market and buy because "everything is going up." Public perceives it is an uptrend and time to get in as all their friends show off money from stock market return. Similarly, the bear market starts with Distribution phase with smart money getting out and weak holders managing the stocks. Followed by huge sell off - a big move, public continues to buy the dips but it keeps dipping, and finally the public panics and sell in despair to be away from stock market for ever. Refer Dow Theory

During the downward market direction, growth stocks gets severely punished, no stock is left alone, everyone is raided. The stock price run-up is like going in an escalator and when it corrects it is like jumping from top floor or broken elevator screeching down suddenly. When I try to buy it will fail and I try to cut the loss. More loss cutting indicates for me, it is not a good market. I NEVER EVER AVERAGE DOWN ON LOSING POSITION. I will cut the loss and move on.

Be cautious or 100% in cash during the downtrend, this will help you to protect your hard earned capital and mental emotions.

During a bull phase, the market can pullback (< 5%), correct (5-20%), like minor fluctuation waves of topping and bottoming. As a growth stock trader, your job is to trade always in an uptrend market direction. No market move goes up in a straight line. There'll be minor corrections. They are the GREATEST opportunity for traders. As a growth stock trader, the main idea is not to miss a speculative rise after correction. This is the sweet spot. You can make tons of money. Never miss the ride. See the price and volume action. DO NOT LISTEN TO ANY PUNDITS.

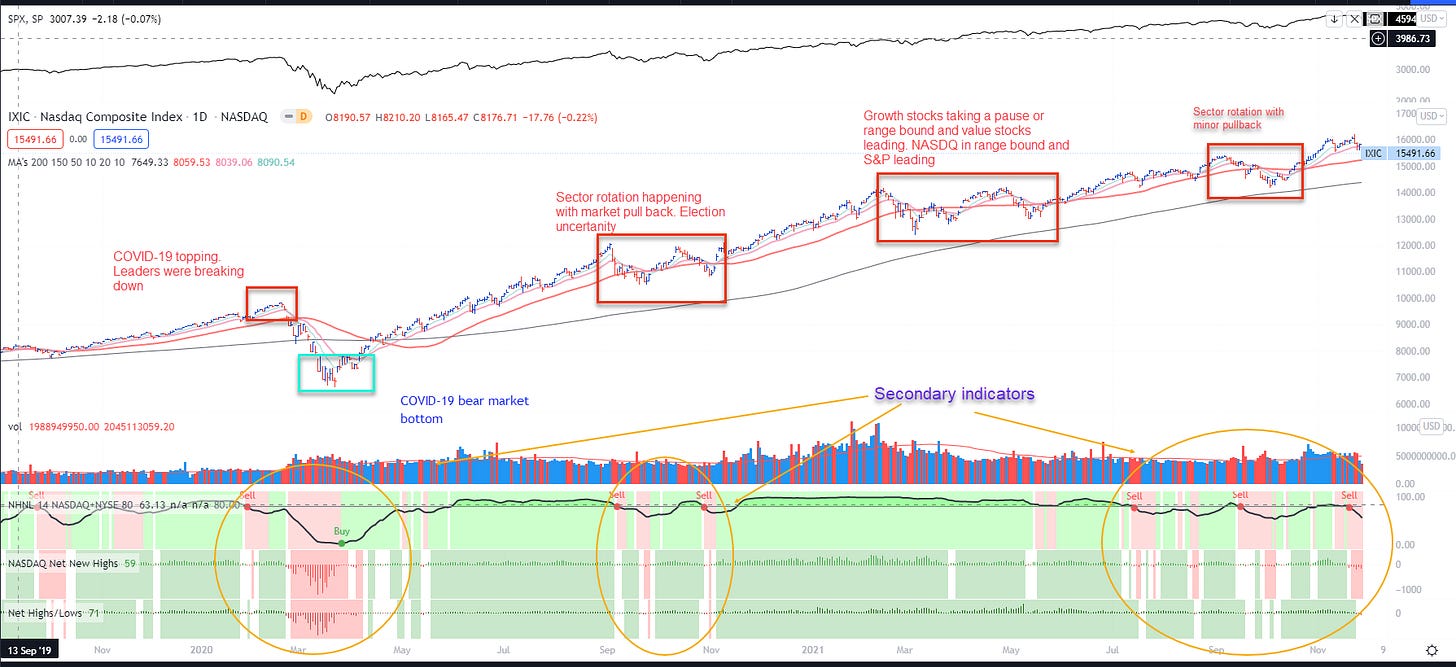

During bull phase, as part of correction, it starts like a minor pull back or shakeout or worst it be can become a bear market (>20%) ; Reminder COVID-19 bear market. I became 100% cash on 24 FEB 2020.

Identifying market top and bottom is not easy but there are many factors to analyze to time the market to some extent. This is like flight dashboard. A holistic view is needed to navigate the turbulence.

I keep it simple (KISS) from my 20 plus of market cycle experience. I don’t want to be manager of too many indicators and avoid paralysis analysis syndrome. I ignore the news /twitters/social discussion on market condition.

MARKET TOP:

Your stocks portfolio performance, you will see pinch of drawdown then like loosing sleep

Your recent stock breakout fails or fails to follow-through

Market Leadership Index - Growth stocks corrects, stall and new base breakout failures (2018) - when the generals (leaders) fall, the troops(all other stocks) will be destroyed. Refer to a nice analogy <tweet>

52 Week High and Low ratio deteriorates (right now in NOV 2021)

Extension of NASDQ and/or S&P 500 above 50 day moving average. Too far from the line, pull back is imminent

Stockbee Market Monitor - a classic indicator on how many stocks are up and down by 4% and volume. Reading this table is an art.

Too much of euphoria (many stocks in climax in 1999; all office friends talk only about stocks or how they smart they are to pick and make money - January 2020). The market seems easy. Even my dog can a pick a stock and make money. It won’t last long.

A bellwether company can give a dim outlook and collapse the entire sector then pull down the market itself

Use IBD Market pulse to get an idea on the market distribution (not a scientific one, they are lagging indicator, lessons learned)

Greed/Fear Index gauge - least of my worry

As the top occurs, you will start liquidating the stocks and stop buying new ones. Target to be in 100% ca$h during the correction phase. Or you might hold only high conviction stock that has a huge profit cushion. Else get out of hell by cutting the loss in ruthless way. A bear market can be emotional toll.

MARKET BOTTOM:

Stockbee Market Monitor - a classic indicator on how many stocks are up and down by 4% and volume

FISHING - Lookout for odd sector out of the blue breaking out and find strongest stocks in that pact - your previous favorite sector will be lagging so focus what the market tells and not what you think or other people opinion. An illiquid stock might break out and you want to fish for a fundamentally strong stock in that group. I noticed LVNGO breaking out at COVID-19 market bottom.

Confirmed by 52 Week Net High and Low ratio improvement 3 days in a row

IBD Market Pulse calls for an uptrend (most reliable indicator) - FTD. I love this indicator. As the market bottoms, there will be lots of washout day with huge volume break out. Lot of these will be bear trap. When you get a FTD with solid stocks breaking out. It is a signal to get exposed gradually.

T2108 value will be below 20 - DESPAIR (BEST ONE FOR BEAR MARKET BOTTOM FISHING. INVEST IN 3X ETF of TNA, SOXL, LABU, TQQQ)

Greed/Fear Index gauge - least of my worry

COVID-19 bear market is an exception due to monetary and fiscal policy - FED injected a huge liquidity and congress passed stimulus package. So it is a short lived and a V recovery. DO NOT FIGHT THE FED. When market bounces back, go with the trend. Our objective is to trade and profit not to argue about economy or pandemic.

Outlier scenarios on corrections. Not an outright panic in the market but sectors transition happening seamlessly without any bloodbath in the market. In these cases you are not pulling yourself out of the market but focus shift to different sectors. Lessons learned don’t have any bias to any sectors at any time:

One index correct but other index runs fine. Example NASDAQ vs S&P in Spring of 2021. That means you need to fish in a different pond, not your typical technology, consumer discretionary and healthcare time but value stocks leading the index.

The pull back or correction is mild. The previous leaders were trashed and new leadership continue to emerge. What this means, it is an index pull back but damage is minimal across the board. Fundamentally strongest stocks resisting the market correction breaks out from a constructive base or consolidation even before market FTD (follow through day) . You shift your portfolio towards these stocks.

As the bottom occurs, on a confirmed uptrend you will start buying stocks and continue the exposure on strongest stocks breaking out. But, be cautious as many rallies fade and short lived.

Start creating market leadership index to see how the group acts or fade or gets rotated.

SECTOR STRENGTH

Once the market trend signal is up, next you need to find what stocks are acting well, meaning resisting the correction or minimized the damage. What sector or industry group it belongs to. Is it just this stock or bunch of stocks in that group acting well. This is the strongest sector you want to be in for superior returns. You really want to be in top 20 sectors. In my personal experience, stocks lead first then it flocks the entire group creating a leading sector/industry. It is catch 22 rule.

RELATIVE STRENGTH

Stocks that shows relative strength in the market correction are the best of breed. It can be identified different methods. Guys nothing is easy to make money.

Stocks that resists the correction. This can be measured against the S&P 500. Primary bullish indicator. Jim Roppel refers this as basketball pushed under water due to general market condition and ready to burst out when it turns up

Find stocks showing relative strength of price performance in last 3 months compared to all stocks

Relative momentum ranking (IBD)- stock has performed really well in last one year compared to other stocks . This is secondary for me.

MY OBEJECTIVE IS NOT TO PREDICT THE exact TOP AND absolute BOTTOM OF THE MARKET. BUT TO BE PART OF SPECULATIVE UPTREND WITH THE GENERAL MARKET DIRECTION WHILE IT LAST. AND, STAY CAUTIOUS DURING CORRECTION OR ~ 100% CASH IF NEEDED. IN AN UPTREND, BUY BEST STOCKS AND MAKE MONEY OUT OF IT AS A SWING OR HOME RUN. CUT LOSS WHEN I AM WRONG.

“The whole secret to winning big in the stock market is not to be right all the time, but to lose the least amount possible when you’re wrong.”

“When you appear to be right always follow up. Size up and position more on the winning stock.”

― William J. O'Neil.

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine–that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.”

- Jesse Livermore

This is the holly grail of this trading method.

Model Stock Analysis - EICHERMOT

Amazing article with lot of insightful information, thanks for sharing!